√70以上 yield to maturity calculator formula 324688-Yield to maturity calculator formula

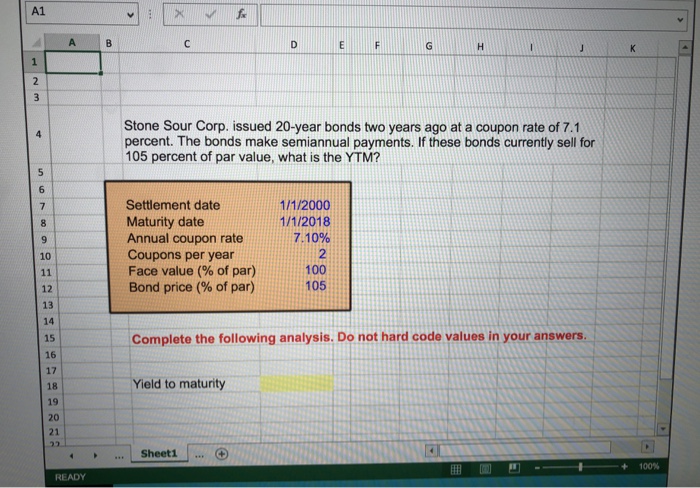

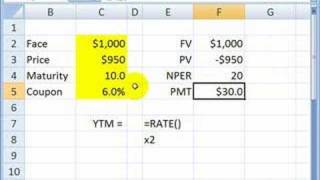

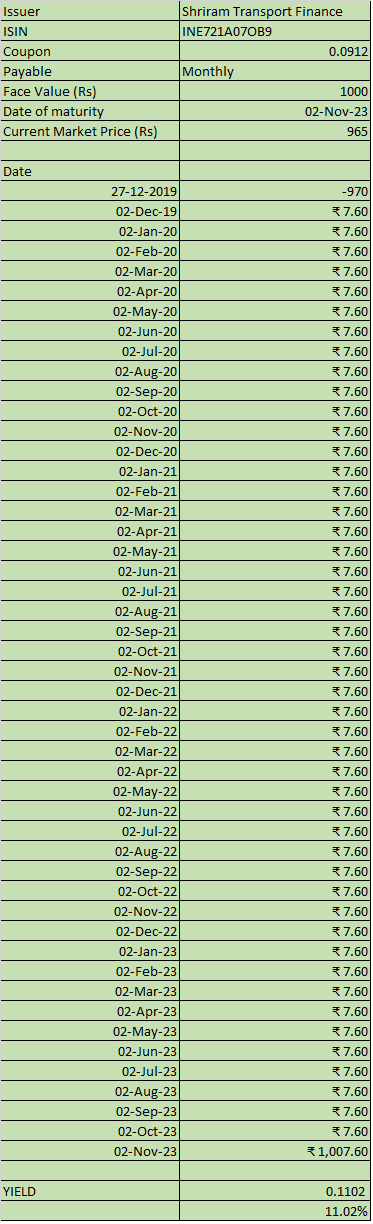

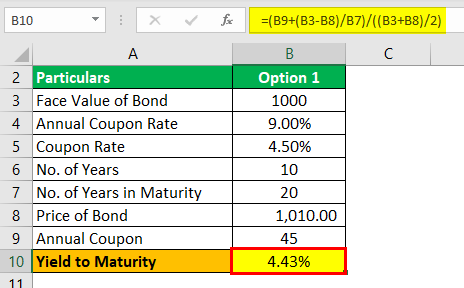

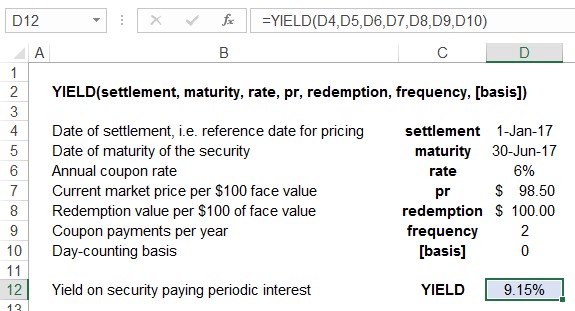

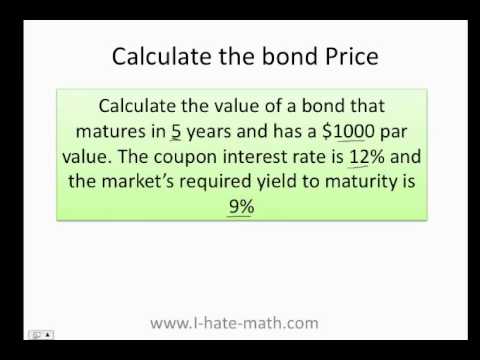

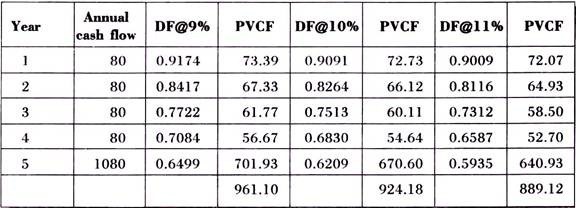

Enter the bond yield formulas Click in cell B13 and type the following formula =(*B2)/B10 Click in cell B14 and enter the next formula =RATE(B5*B8,/B8*B2,B10,B2)*B8 Click in cell B15 and type =RATE(B6*B8,/B8*B2,B10,B2*(1))*B8R – Rate of Interest;Yield to Maturity is calculated using the formula given below YTM =Coupon Prorated Discount /(Redemption Price Purchase Price)/2 YTM = 630 ($1350 / 5) / ($104 $90) / 2

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Yield To Worst Ytw Definition

Yield to maturity calculator formula

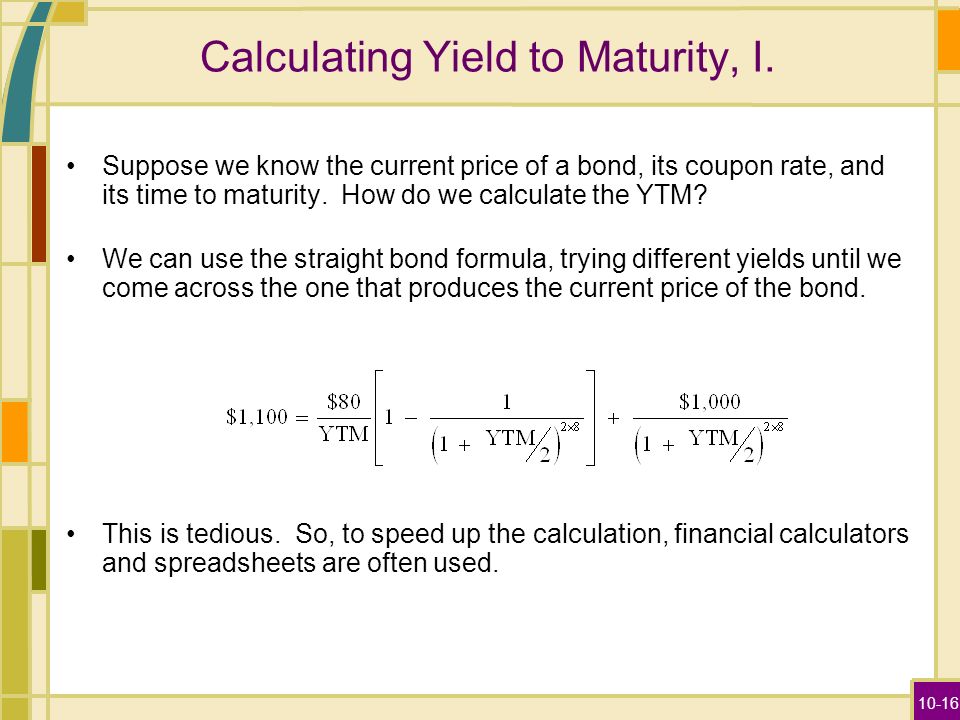

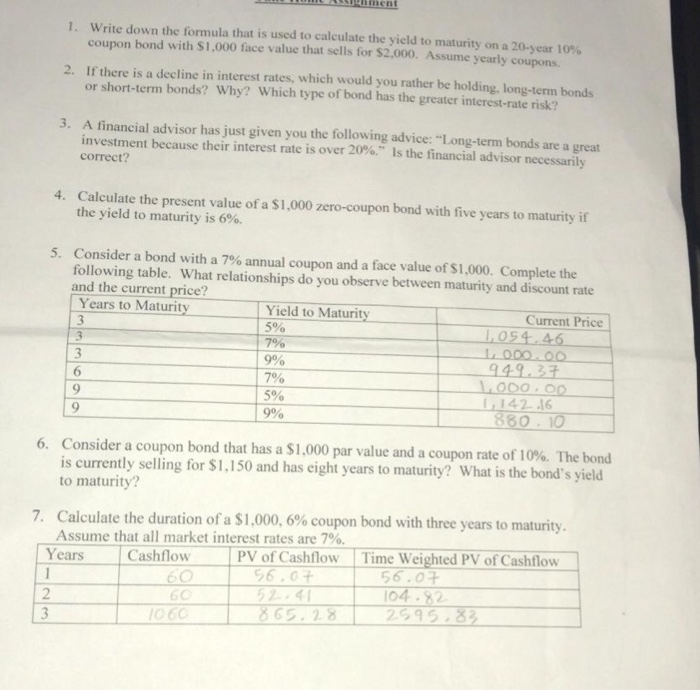

Yield to maturity calculator formula-Free loan calculator to determine repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans, and bonds Also, learn more about different types of loans, experiment with other loan calculators, or explore other calculators addressing finance, math, fitness, health, and many moreThe yield to maturity formula is very simple if the par value equals the market value At that point, the yield to maturity is simply the coupon rate However, this is rarely the case Therefore, for the many times the market value doesn't equal the par value, the yield to maturity is the same as calculating the IRR(Internal Rate of Return) on any investment It is a calculation measuring the cash flows starting with the purchase of the bond, the coupon payments while holding the bond, and

Calculating Yield To Maturity Using The Bond Price

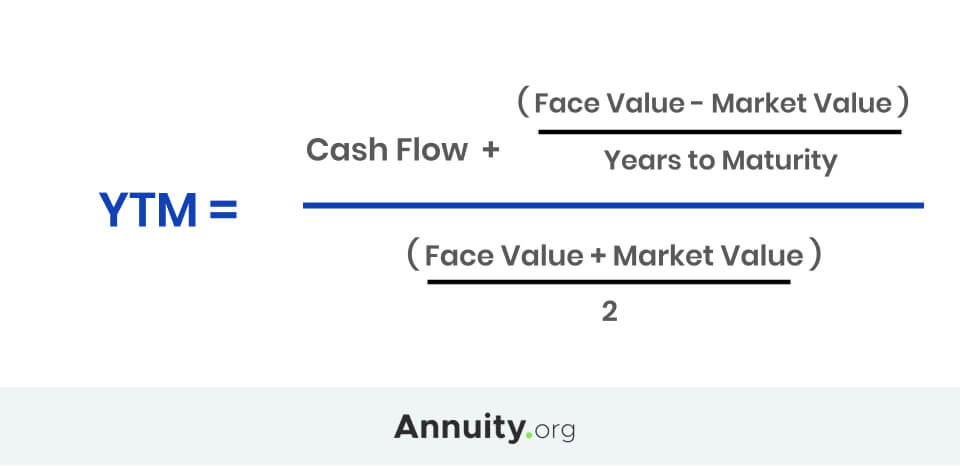

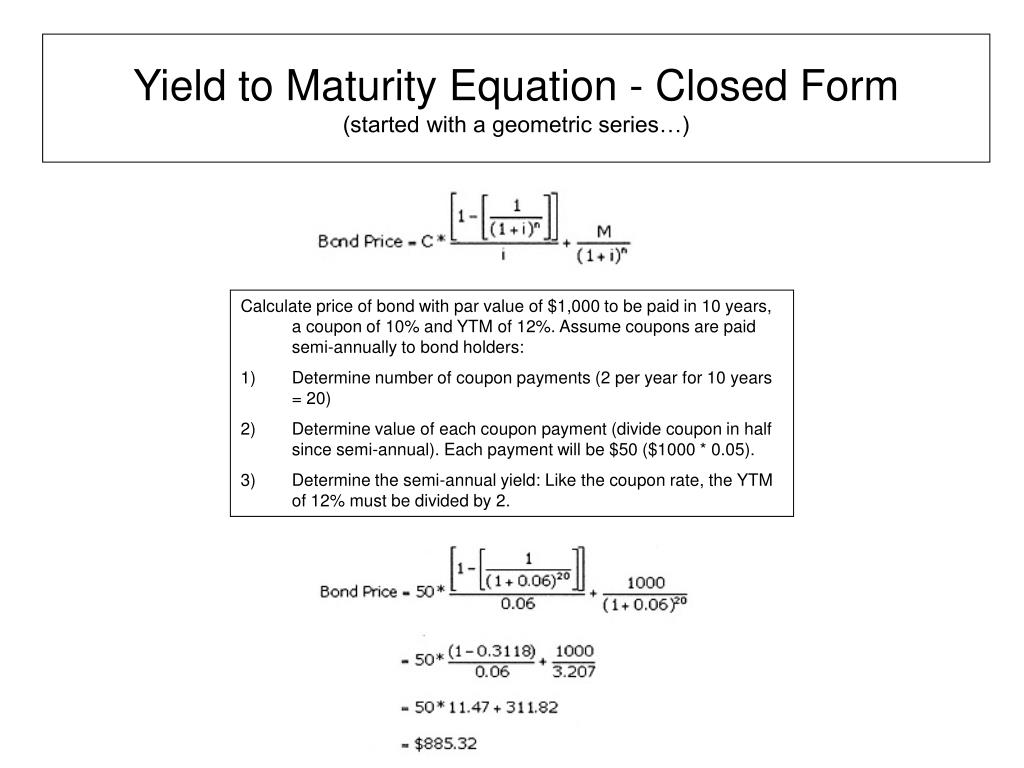

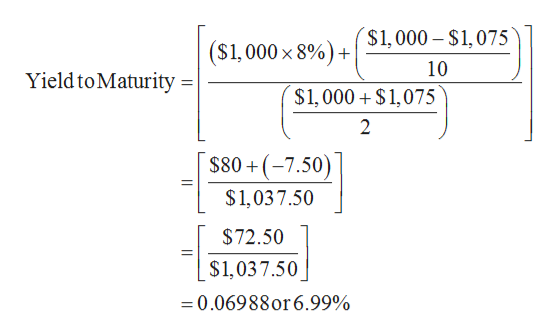

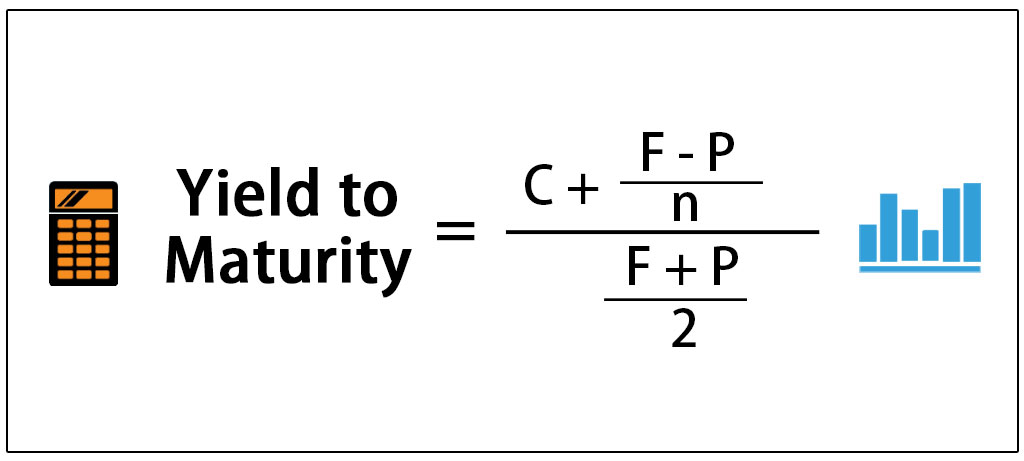

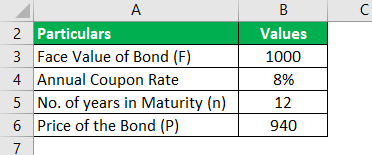

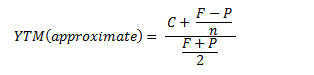

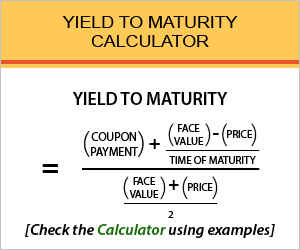

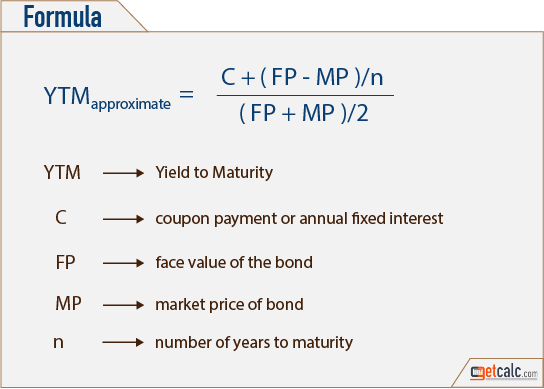

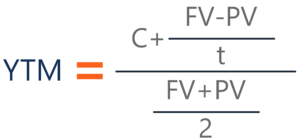

Yield to Maturity Formula The following formula is used to calculate the yield to maturity of a bond or investment YTM = (AIP) ( (FV – CP) / (Y) ) / ( FV CP ) / 2 Where YTM is the yield to maturity;N = number of semiannual periods left to maturity Let's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850 The calculation of YTM is shown below Note that the actual YTM in this example is 987%Use the belowgiven data for calculation of yield to maturity We can use the above formula to calculate approximate yield to maturity Coupons on the bond will be $1,000 * 8%, which is $80 Yield to Maturity (Approx) = (80 (1000 – 94) / 12 ) / ( (1000 940) / 2) Yield to Maturity will be –

The exact equation for yield to maturity is C (1R)^ (1) C (1R)^ (N) F (1R)^ (N) = B, where R is the YTM Even if you know the values for C, F, B and N, this equation cannot be solved for R However, the simple yield to maturity formula gives a good approximation for RYield to Maturity Example Suppose you purchased a bond with a face value of $ 1, with a period of 7 years The interest coupon rate is 12% and the issue price of the bond at 1000 YTM = (C ( (Fp)/n))/ ( (FP)/2) = 1R – Rate of Interest;

V = P * (1 R) ^ T Where V – Maturity Value P – Principal Invested R – Rate of Interest T – Time of Investment In case of a bond which pays periodic coupon payments, the maturity value is basically the par value of the bondFree loan calculator to determine repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans, and bonds Also, learn more about different types of loans, experiment with other loan calculators, or explore other calculators addressing finance, math, fitness, health, and many moreYield to Maturity Calculator getcalccom's Yield to Maturity (YTM) Calculator is an online stock market tool to measure the approximate rate of return for the bond, in percentage if the bond is held until its maturity Yield to Maturity is a finance function or method used in the context of stock market, often abbreviated as YTM, is a long term yield represents an expected total return for the bond, in percentage if the bond is held until its maturity, whereas, YTC Yield t Call represents

P2tdoqhmnx Yjm

Yield To Maturity Ytm And Yield To Call Ytc alectures Com

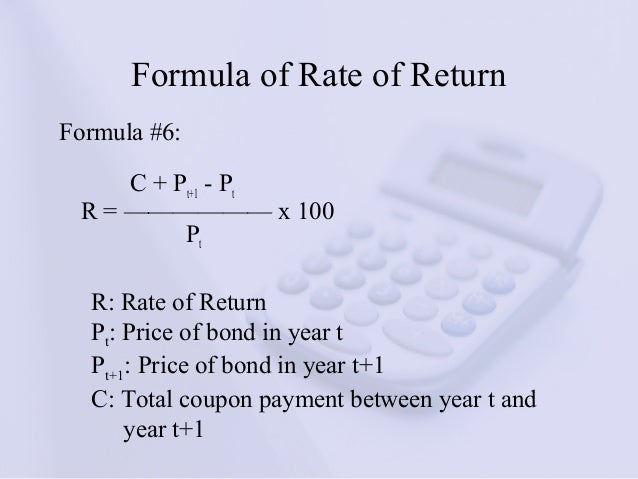

Even though the yieldtomaturity for the remaining life of the bond is just 7%, and the yieldtomaturity bargained for when the bond was purchased was only 10%, the annualized return earned over the first 10 years is 1625% This can be found by evaluating (1i) from the equation (1i) 10 = (2584/573), givingThe formula of current yield Coupon rate / Purchase price Naturally, if the bond purchase price is equal to the face value, current yield will be equal to the coupon rate Current Yield= 160/2,000 = 008 or 8% Let's say the purchase price falls to 1,800 Current Yield= 160/1,800= 00 or % Current Yield rises if the purchase price fallsCP is the current price;

Current Yield Meaning Importance Formula And More

Solved Calculate The Ytm Using Excel Formula And Cells S Chegg Com

Y is the years to maturity;A C F P = 1 0 0 9 2 0 = 1 0 8 7 % \frac {ACF} {P} = \\~\\ \frac {100} {9} = 1087\% P AC F = 9100 = 1087% So, a bond trading at $9 with a face value of $1000 and a 10% interest rate has a 1087% current yield, higher than the one stated by the bondThis yield to maturity calculator uses information from a bond and calculates the YTM each year until the bond matures It uses the par value, market value, and coupon rate to calculate yield to maturity

How To Calculate Yield To Maturity 9 Steps With Pictures

Frm How To Get Yield To Maturity Ytm With Excel Ti Ba Ii Youtube

Bond Yield Calculation Formula It is the formula used to find out for the anticipated annual rate return of the bond Let us understand the bond yield equation under the current yield in detail Bond Yield Formula = Annual Coupon Payment / Bond PriceTo apply the yield to maturity formula, we need to define the face value, bond price and years to maturity For example, if you purchased a $1,000 for $900 The interest is 8 percent, and it will mature in 12 years, we will plugin the variables C = 1000*008 = 80The following formula is used to calculate the yield to maturity of a bond or investment YTM = (AIP) ((FV – CP) / (Y)) / (FV CP) / 2 Where YTM is the yield to maturity AIP is the annual interest payment

Bond Yield To Maturity Ytm Calculator

Finding Bond Price And Ytm On A Financial Calculator Youtube

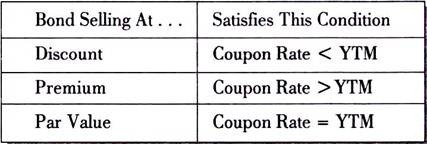

Maturity Value Definition A maturity to value is a measure of how much an investment will make at "maturity"Maturity Value Formula The following formula can be used to calculate the maturity value of an investment V = P * (1R)^T V – Maturity Value;Higher than the yield to maturity, the bond will be trading at a premium Equal to the yield to maturity, the bond will be trading at face value Yield to Maturity Formula Approx YTM = { C ( F P ) / n } / ( F P ) / 2 where C = Coupon / Interest payment;

Calculating Yield To Maturity Using The Bond Price

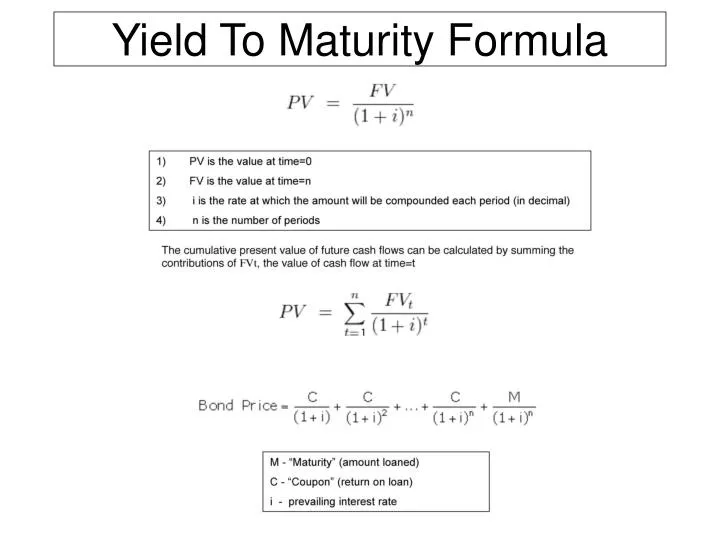

Fin 360 Corporate Finance Ppt Download

AIP is the annual interest payment;Expressed as an annual percentage, the yield tells investors how much income they will earn each year relative to the cost of their investment Formula to calculate yield to maturity C – Interest/coupon payment FV – Face Value of the bond PV – Present value of the bond t – Number of years it takes the bond to reach maturity ExampleYield to Maturity Example

Tool To Calculate The Bond Price Using Python Exploring Finance

1

This calculator shows the current yield and yield to maturity on a bond;T – Time of Investment;Annual percentage yield (APY) is calculated by using this formula APY= (1 r/n)n n – 1 In this formula, "r" is the stated annual interest rate and "n" is the number

Yield Function Formula Examples Calculate Yield In Excel

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

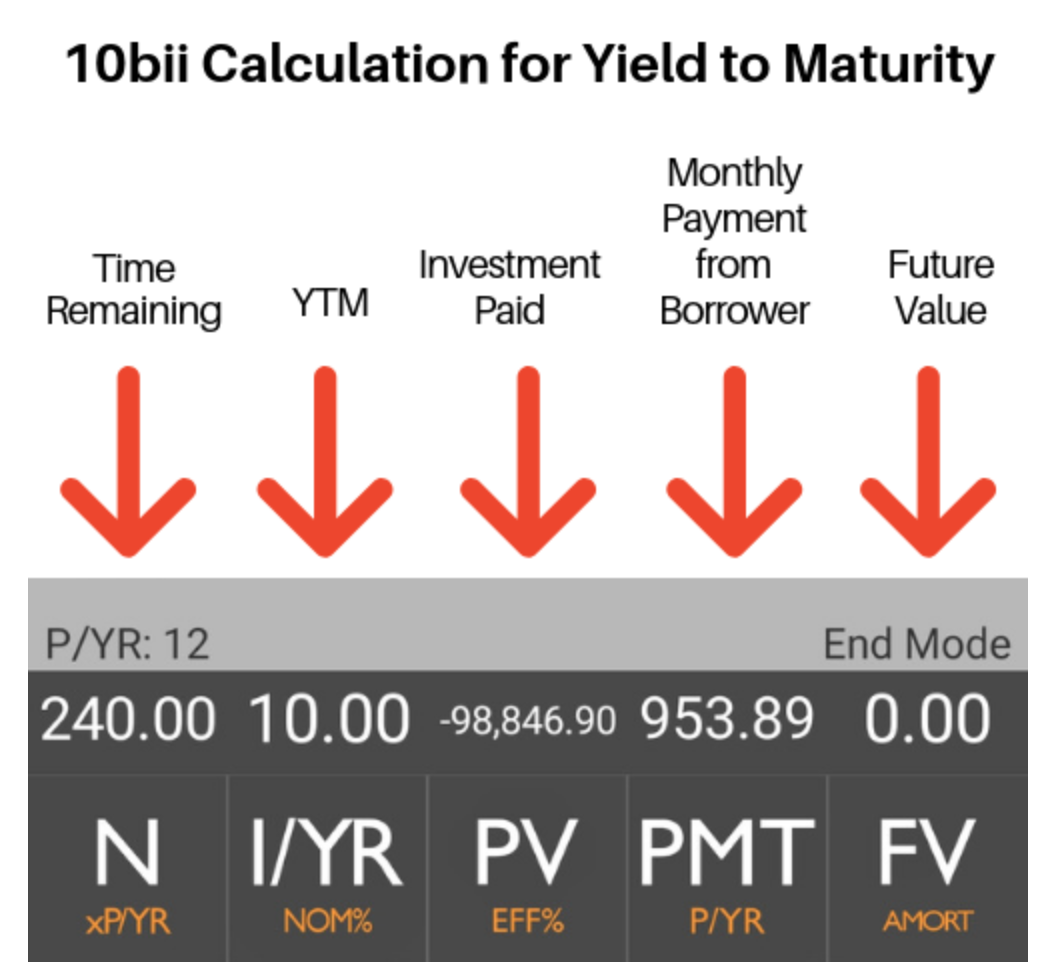

You can use Excel's RATE function to calculate the Yield to Maturity (YTM) Check out the image below The syntax of RATE function RATE (nper, pmt, pv, fv, type, guess) Here, Nper = Total number of periods of the bond maturity Years to maturity of the bond is 5 years But coupons per year is 2 So, nper is 5 x 2 = 10P – Principal Invested;T – Time of Investment;

Yield To Maturity Calculator Calculator Academy

Yield To Call Ytc Calculator

Free Online Textbook @ https//businessfinanceessentialspressbookscom/An example of calculating YieldtoMaturity using the 5key approachSolution Here we have to understand that this calculation completely depends on annual coupon and bond price It completely ignores the time value of money, frequency of payment, and amount value at the time of maturity Step 1 Calculation of the coupon payment Annual Payment =$1800*9% Annual Payment = $162Plugging in the calculation formula, you calculate the yield as follows 1 (07/2) 2 – 1 = 7123% To see how the number of annual coupon payments received affects the effective yield on your bond, let us do another effective yield calculation that assumes you receive monthly coupon payments – 12 interest payments each year

What Is Yield To Maturity How To Calculate It Scripbox

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

There are two common measures of yield current yield and yield to maturity Current yield equals the annual interest payment divided by the current market price of the security Yield to maturity is the internal rate of return of a security which means it is the rate an investor will earn by purchasing the security at its current price and receiving all future cash flows, such as coupon payments till maturity and the maturity valueThe formula for the approximate yield to maturity on a bond is ((Annual Interest Payment) ((Face Value Current Price) / (Years to Maturity)))V = P * (1 R) ^ T Where V – Maturity Value P – Principal Invested R – Rate of Interest T – Time of Investment In case of a bond which pays periodic coupon payments, the maturity value is basically the par value of the bond

Yield To Maturity Ytm Calculator

Yield To Maturity Formula Step By Step Calculation With Examples

Maturity Value Formula The following formula can be used to calculate the maturity value of an investment V = P * (1R)^T V – Maturity Value;It is a static value of the security PV – Present value/price of the security t – How many years it takes the security to reach maturity The formula's purpose is to determine the yield of a bond (or other fixedasset security) according to its most recent market priceN = years to maturity;

How Do I Calculate Yield To Maturity Ytm With A Simple Handheld Calculator For Semiannual Payments Personal Finance Money Stack Exchange

Yield To Maturity Calculator Ytm Calculator

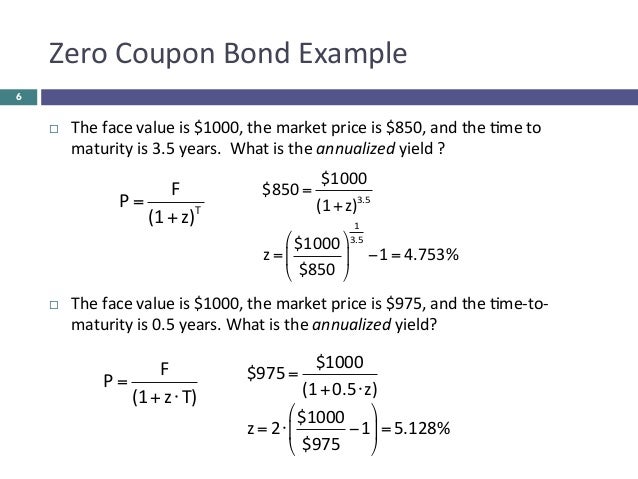

Maturity Value Definition A maturity to value is a measure of how much an investment will make at "maturity"Yield to maturity can also be calculated using the following approximation formula Where C is the annual coupon amount, F is the face value of the bond, P is the current bond price and n is the total number of years till maturity Alternatively, we can also use Microsoft Excel YLD function to find yield to maturityFV is the face value;

Bond Yield Calculator

Explained How To Calculate Yields On Your Bond Investments

Yield to Maturity Examples C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon paymentsThe calculator uses the following formula to calculate the yield to maturity P = C×(1 r)1 C×(1 r)2 C×(1 r)Y B×(1 r)Y Where P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturityF = Face value;

Yield Curve How Yield Curve Changes Affect Annuities

Bond Value Calculator What It Should Be Trading At Shows Work

Use the Yield Function to Calculate the Answer Type the formula "=Yield (B1,B2,,B4,B5,B6,)" into cell B8 and hit the "Enter" key The result should be percentwhich is the annual yield to maturity of this bondYield to Maturity Calculator Formula Let us go through the formula for good understanding This formula is based on compounding where each coupon of the bond will bear interest for the next period too It is also important to know that the yield hence obtained is of annual basis and determine the yield of one yearHOW DO YOU CALCULATE YIELD?

Cost Of Debt Definition Formula Calculation Example

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Annual percentage yield (APY) is calculated by using this formula APY= (1 r/n)n n – 1 In this formula, "r" is the stated annual interest rate and "n" is the numberThe yield to maturity formula is used to calculate the yield on a bond based on its current price on the market The yield to maturity formula looks at the effective yield of a bond based on compounding as opposed to the simple yield which is found using the dividend yield formulaYield to Maturity Equation One basic formula for calculating yield to maturity looks like this Approximate YTM = (C (F P) / n) / ((F P) / 2) Where YTM = Yield to Maturity

Yield To Maturity Formula Step By Step Calculation With Examples

Stata Codes For Calculating Yield To Maturity For Coupon Bonds Stataprofessor

Yield to Maturity Calculator getcalccom's Yield to Maturity (YTM) Calculator is an online stock market tool to measure the approximate rate of return for the bond, in percentage if the bond is held until its maturity Yield to Maturity is a finance function or method used in the context of stock market, often abbreviated as YTM, is a long term yield represents an expected total return for the bond, in percentage if the bond is held until its maturity, whereas, YTC Yield t Call representsCalculating the Approximate Yield to Maturity Gather the information To calculate the approximate yield to maturity, you need to know the coupon payment, the face C = the coupon payment, or the amount paid in interest to the bond holder each year F = the face value, or the full value of theWith links to articles for more information Bond Yield Formulas See How Finance Works for the formulas for bond yield to maturity and current yield Compound Interest Present Value Return Rate / CAGR Annuity Pres Val of Annuity

Yield To Maturity Formula Step By Step Calculation With Examples

Calculate The Ytm Of A Coupon Bond Youtube

C = the semiannual coupon interest N = number of semiannual periods left to maturity Let's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850P – Principal Invested;To calculate the price for a given yield to maturity see the Bond Price Calculator Face Value This is the nominal value of debt that the bond represents It is the amount that is payed to the holder of the bond on the date that it matures, also called the redemption date

Q Tbn And9gcs8pllmjk Cwco2cxddqmohomgedhyw Veiacyoq Lypi38bu2o Usqp Cau

Coupon Rate Vs Yield Rate For Bonds Wall Street Oasis

HOW DO YOU CALCULATE YIELD?Yield To Maturity (YTM) Calculator Online financial calculator to calculate yield to maturity based annual interest, par/face value, market price and years to maturity of bond Online financial calculator to calculate yield to maturity based annual interest, par/face value, market price and years to maturity of bond Just copy and paste the below code to your webpage where you want to display this calculatorYield to Maturity Example Suppose you purchased a bond with a face value of $ 1, with a period of 7 years The interest coupon rate is 12% and the issue price of the bond at 1000 YTM = (C ( (Fp)/n))/ ( (FP)/2) = 1

How To Calculate Yield To Maturity 9 Steps With Pictures

Bond Equivalent Yield Formula Calculator Excel Template

Yield to Maturity = 429 % CALCULATE CALCULATEYield to Maturity Equation One basic formula for calculating yield to maturity looks like this Approximate YTM = (C (F P) / n) / ((F P) / 2)Yield To Maturity Definition

Valuing Bonds Boundless Finance

10 Bond Prices And Yields Ppt Video Online Download

Yield To Maturity Ytm Overview Formula And Importance

Learn To Calculate Yield To Maturity In Ms Excel

How To Calculate Yield To Maturity 9 Steps With Pictures

Bond Yield Calculator

Best Excel Tutorial How To Calculate Ytm

Forward Looking Return Calculation Bondora Portfolio

How To Calculate Yield To Maturity 9 Steps With Pictures

Bond Price Calculator Present Value Of Future Cashflows Dqydj

Finding Yield To Maturity Using Excel Youtube

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id

Answered How Do You Calculate Yield To Maturity Bartleby

Excel Ytm Calculator Calculator Spreadsheet Free Download

Bond Pricing Formula How To Calculate Bond Price

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Yield To Maturity Definition How To Calculate Ytm Pros Cons

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Yield To Maturity Calculation In Excel Example

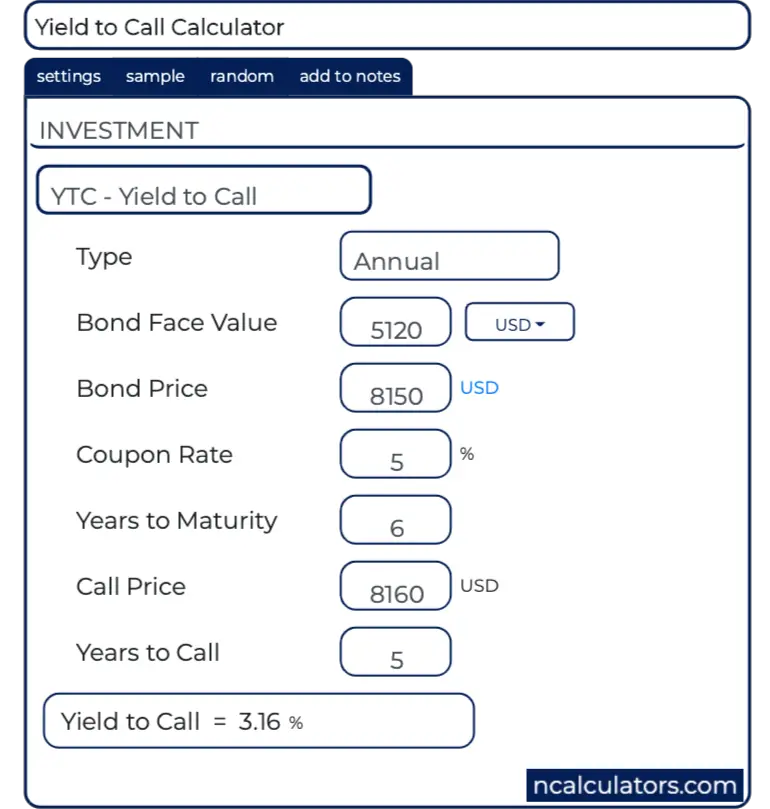

How To Calculate Yield For A Callable Bond The Motley Fool

Frm Ti Ba Ii To Compute Bond Yield Ytm Youtube

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

Yield To Maturity Ytm Calculator

How To Use The Excel Yield Function Exceljet

The Yield To Maturity And Bond Equivalent Yield Fidelity

Yield To Maturity Ytm Definition Formula And Example

Yield To Maturity Ytm Formula Interest And Deposit Calculators

Yield To Maturity Approximate Formula With Calculator

Yield To Maturity Ytm Definition Formula Method Example Approximation Excel

Solved What Is The Yield To Maturity On A Simple Loan For Chegg Com

Learn To Calculate Yield To Maturity In Ms Excel

Calculating The Yield To Maturity Ytm Of A Bond Financial Management

Bond Yield Formula Calculator Example With Excel Template

How To Calculate Yield To Maturity 9 Steps With Pictures

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Zero Coupon Bond Yield Calculator Ytm Of A Discount Bond

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Free Bond Valuation Yield To Maturity Spreadsheet

Bond Yield To Call Ytc Calculator

Yield To Maturity Formula Step By Step Calculation With Examples

How To Calculate The Bond Price And Yield To Maturity Youtube

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

Yield To Maturity Calculator Find Formula Check Example More

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Q Tbn And9gctacaieid4sboc7gfwy42ckuxutk9izg3v4wua1wzgqipvknrom Usqp Cau

Best Excel Tutorial How To Calculate Yield In Excel

Vba To Calculate Yield To Maturity Of A Bond

Zero Coupon Bond Yield Formula With Calculator

Ytm Yield To Maturity Calculator

Excel Bond Calculator For 21 Printable And Downloadable Gust

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Solved Write Down The Formula That Is Used To Calculate T Chegg Com

How To Calculate Spot Rates Forward Rates Ytm In Excel Financetrainingcourse Com

Yield To Worst What It Is And Why It S Important

Calculating The Yield To Maturity Ytm Of A Bond Financial Management

Yield To Maturity Ytm Overview Formula And Importance

What Is A Zero Coupon Bond

What Is Yield To Maturity How To Calculate It Scripbox

What Is Yield To Maturity Ytm Millionacres

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Yield To Worst Ytw Definition

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Yield To Maturity Fixed Income

Q Tbn And9gct1q6zxynbcvmgspi Wpg Zzjvgvz 1ltnjyviqmbaypurzxz Usqp Cau

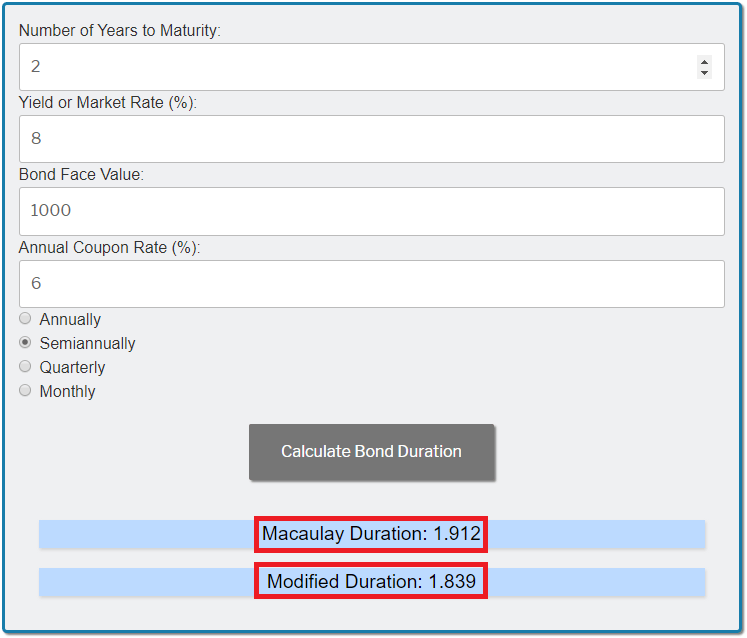

Bond Duration Calculator Exploring Finance

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Best Excel Tutorial How To Calculate Yield In Excel

Calculating The Annual Yield Of A Security That Pays Interest At Maturity Yieldmat

コメント

コメントを投稿